Supplier Invoice Automation

The Arcplace solutions help organisations to digitize and automate the following steps of the accounts payable process:

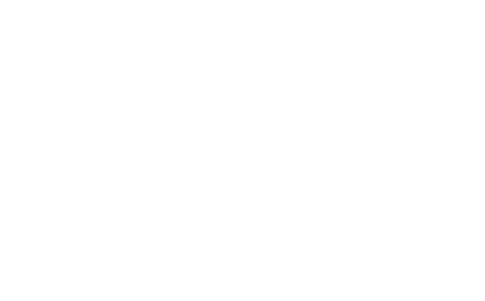

1. Invoice Reception

For paper invoices, Arcplace offers solutions for efficiently scanning and capturing invoice data. PDF invoices can be processed using the same capture technology or by using a service, that allows extracting data from PDF files in a fully automated matter. For e-invoices, Arcplace offers solutions for receiving e-invoices from national and international payment providers.

2. Processing

In order to maximize automation, matching is used for invoices that have purchase orders or contracts associated to them. For other invoices, advanced logic and artificial intelligence is used to transfer the invoices to the appropriate people within the organization and for minimizing coding efforts.

3. Archiving

Arcplace offers solutions for archiving the invoice together with their audit trails and invoice attachments. The archiving solutions allow organizations to archive invoices in compliance with both national and international laws and regulations.

Main advantages:

- Extensive usage of electronic invoicing

- Very high degree of automation

- Standardized interfaces to various ERPs

- Very well suited for international deployments

- Allow compliant processing and archiving

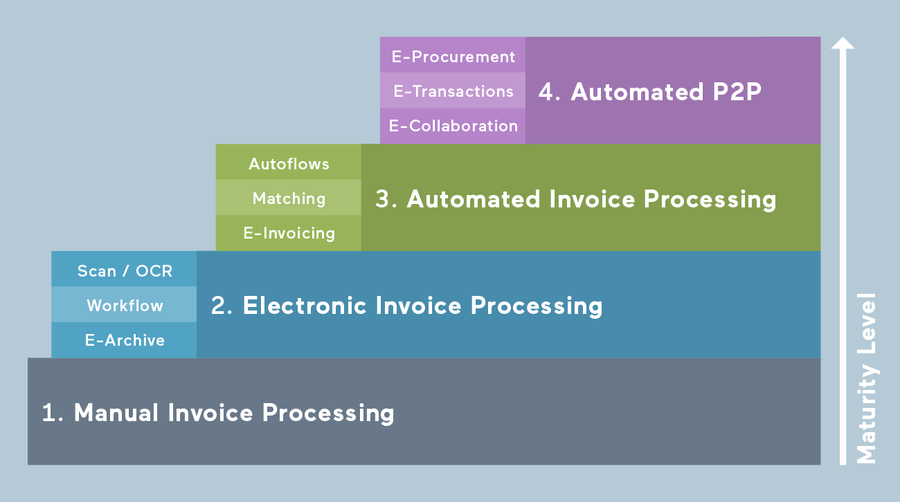

Cost Savings

Numerous studies have shown that the costs of processing a single supplier invoice manually is in the range of 12 to 30 CHF. First generation solutions typically allow saving a third of these costs. As shown in the figure below, significant additional savings are possible by modernizing or enhancing these "first generation" solutions.

Purchase-to-Pay

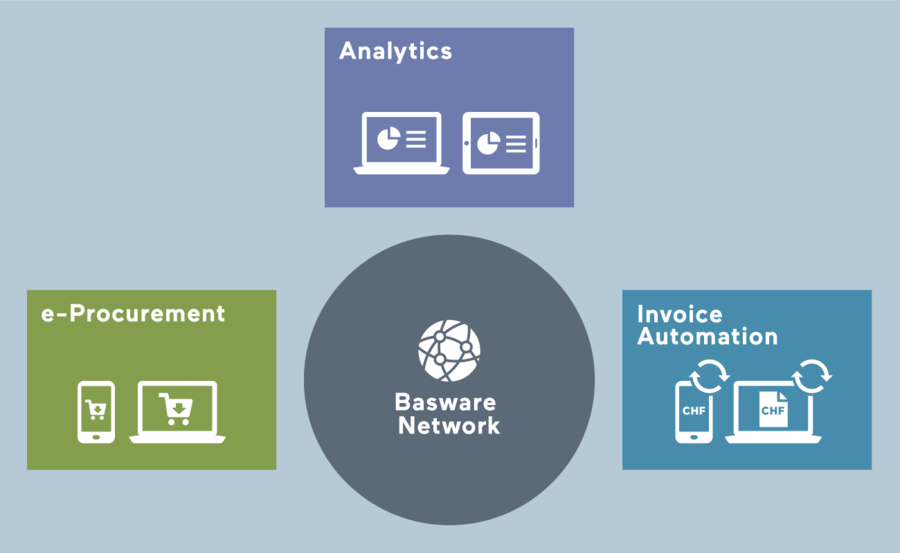

In order to optimize the entire Purchase-to-Pay (P2P) process, Arcplace deploys the Basware P2P suite that consists of the following components:

- e-Procurement: For generating purchase orders for indirect spend

- Invoice Automation: For automating the invoice approval process

- Analytics: For insight into the complete P2P process

- Basware Network: For exchanging e-Invoices and e-Orders with suppliers

With your personal demo version through the Purchase-to-Pay (P2P) process

The Purchase-to-Pay process covers all processes in your company "from purchase to payment". In order to optimize the entire Purchase-to-Pay (P2P) process, Arcplace deploys the Basware P2P suite that consists of the components e-procurement, invoice automation, analytics and Basware Network. With a free, limited demo account, you can run through the purchasing process (Purchase) and the invoice automation process (AP Automation) as you like.